By Alison McGuire, Irish Tech News

With new EU regulations coming into place next September, Mastercard is predicting a significant increase in the use of biometric technology to authenticate who is paying.

With regards to card payments, currently just 1-2% of online transactions require cardholder authentication to complete a transaction (most likely using a password), but this is set to rise to up to 25% or 1 in 4 payments from next autumn.

The European rules aim to tackle online fraud, by increasing the number of transactions subject to two factors of authentication by the payer, known as “Strong Customer Authentication” (SCA).

(Jason Lane provides Mastercard’s views on the main aspects of PSD2. Courtesy of Mastercard News and YouTube. Posted on Jan 18, 2018.)

Authentication for online payments and account access will be based on the use of two or more different factors in the future:

- Something you know, such as a password

- Something you have, such as a phone, or card

- Something you are, such as a fingerprint

This will mostly impact card payments made over the internet – be it a desktop or mobile purchase.

It will also apply to some contactless transactions, as a periodic check to ensure the card is being used by its rightful owner.

However, in-store chip and pin transactions are already complaint and use two factors.

Although the heightened security measures are designed to protect consumers and businesses from being defrauded, Mastercard is working with banks and the rest of the industry to ensure they are implemented without ‘disrupting’ the convenience of payments for consumers.

“The use of passwords to authenticate someone is woefully outdated, with consumers forgetting them and retailers facing abandoned shopping baskets,” said Ajay Bhalla, President Global Enterprise Risk and Security, Mastercard.

“In payments technology this is something we’re closing in on as we move from cash to card, password to thumbprint, and beyond to innovative technologies such as artificial intelligence.”

“It’s far easier to authenticate with a thumbprint or a selfie, and it’s safer too.”

Mastercard has been leading the advancement of biometric technology in payments for years with a focus on improving both consumer experience and security online and offline.

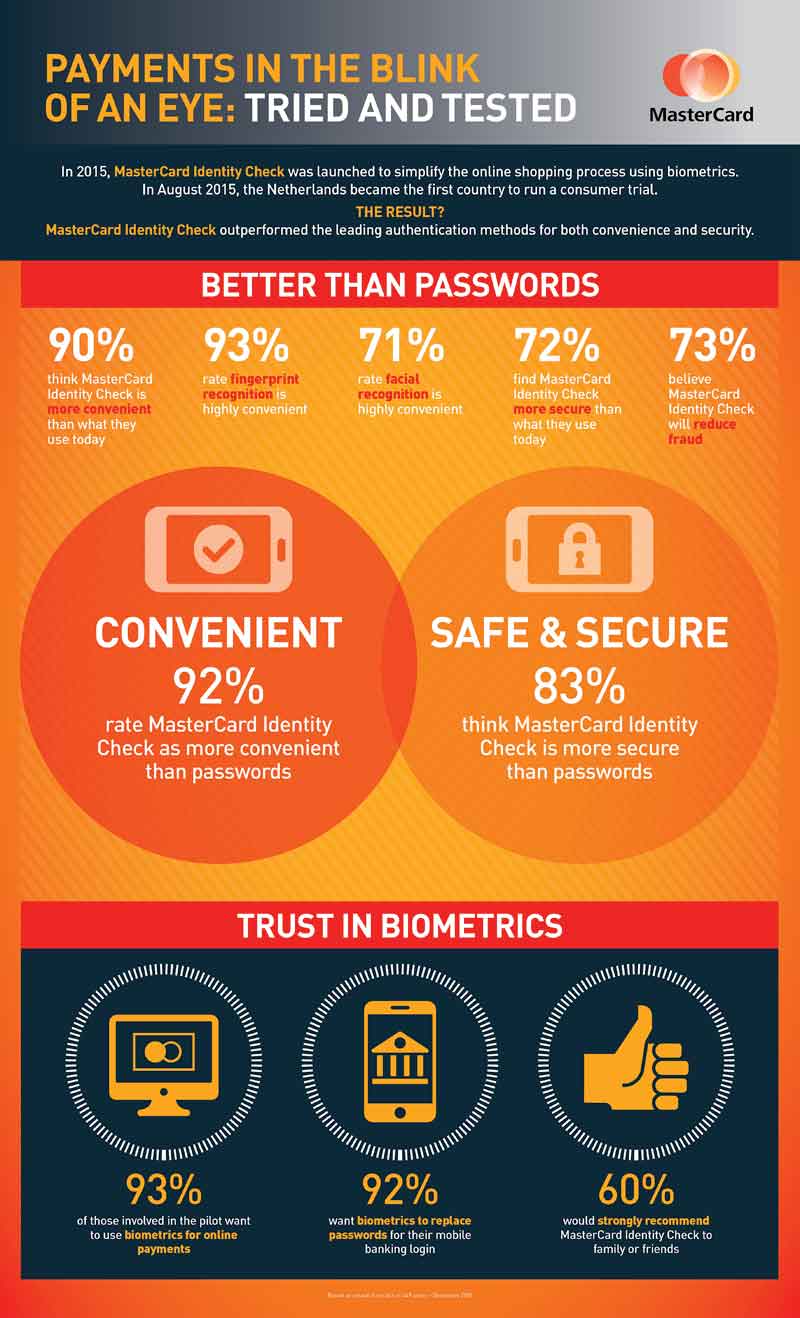

Identity Check is one such example.

This is an authentication solution that enables individuals to use biometric identifiers, such as fingerprint, iris and facial recognition to verify their identity using a mobile device during online shopping and banking activities.

(We heard so often that passwords were a pain we decided to make a video based on our MasterCard Identity Check consumer trial and their feedback. Not only were the insights around passwords interesting but the biometric app results from the consumer trial proved positively there is an appetite for change and the removal of passwords. Courtesy of Mastercard News and YouTube. Posted on Feb 23, 2016.)

This solution dramatically speeds up the digital checkout time, improves security and reduces cart abandonment rates.

Mastercard is also testing a next generation biometric payment card, with an in-built fingerprint sensor.

The card is being piloted in South Africa and can be used to verify in-store purchases without the need to upgrade existing payment terminals.

With this approach, Mastercard will help banks not only to comply with requirements set out in the new PSD2 legislation, but also to go further in optimizing the checkout experience of their customers.